Stages of Purchase Order Activity

PeopleSoft Financials 9.2

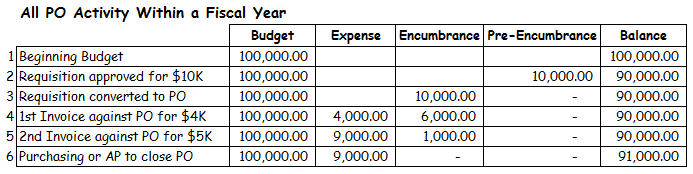

The below illustrations walk through the impact of various scenarios of purchase order activity on a department budget:

- This scenario assumes a beginning budget of $100,000

- When a requisition for $10,000 is approved, a pre-encumbrance of $10,000 is posted against the budget bringing the available balance down to $90,000

- When the requisition is converted into a purchase order, the pre-encumbrance is removed and replaced with an encumbrance of $10,000 leaving the available balance at $90,000

- When an invoice (voucher) for $4,000 is processed, $4,000 will now be charged to expenses and the encumbrance reduced by $4,000, resulting in no change to the available balance of $90,000

- When another invoice (voucher) is processed for $5,000, expenses will now increase by $5,000 and the encumbrance reduce by $5,000, resulting in no change to the available balance of $90,000

- When Purchasing or Accounts Payable closes out this purchase order, the remaining $1,000 in encumbrance will be be removed and increase the available balance by $1,000

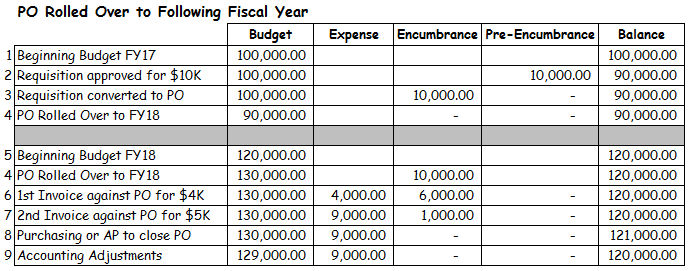

- This scenario assumes a beginning budget of $100,000 in Fiscal Year 2017

- When a requisition for $10,000 is approved, a pre-encumbrance of $10,000 is posted against the budget bringing the available balance down to $90,000

- When the requisition is converted into a purchase order, the pre-encumbrance is removed and replaced with an encumbrance of $10,000 leaving the available balance at $90,000

- At the end of the fiscal year (June 30th) if there has been no invoice (voucher) activity on the purchase order, it will be flagged to roll over into the next fiscal year.

- PO Rollover removes the $10,000 encumbrance in FY17 and posts the encumbrance in FY18.

- Simultaneously, the Budget Office will decrease the FY17 budget by the amount of the rolled PO.

- The Budget Office will also increase the FY18 budget by the amount of the rolled PO resulting in no change to the available balance. (NOTE: the FY18 budget will only be increased if the department had sufficient budget funds in FY17 to cover the purchase order amount.)

- This scenario assumes a beginning budget of $120,000 in Fiscal Year 2018

- When an invoice (voucher) for $4,000 is processed, $4,000 will now be charged to expenses and the encumbrance reduced by $4,000, resulting in no change to the available balance of $120,000

- When another invoice (voucher) is processed for $5,000, expenses will now increase by $5,000 and the encumbrance reduce by $5,000, resulting in no change to the available balance of $120,000

- When Purchasing or Accounts Payable closes out this purchase order, the remaining $1,000 in encumbrance will be be removed and increase the available balance by $1,000

- Depending on the significance of the amount, the Budget Office may reduce the amount of the budget by the amount of the encumbrance relieved during the closing of the PO

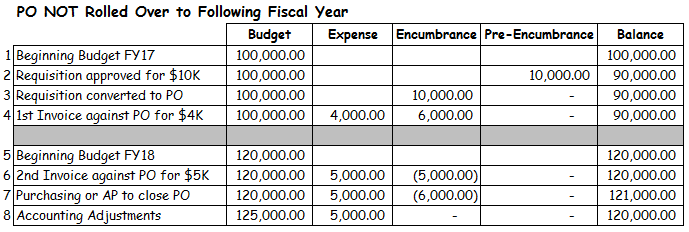

- This scenario assumes a beginning budget of $100,000 in Fiscal Year 2017

- When a requisition for $10,000 is approved, a pre-encumbrance of $10,000 is posted against the budget bringing the available balance down to $90,000

- When the requisition is converted into a purchase order, the pre-encumbrance is removed and replaced with an encumbrance of $10,000 leaving the available balance at $90,000

- When an invoice (voucher) for $4,000 is processed, $4,000 will now be charged to expenses and the encumbrance reduced by $4,000, resulting in no change to the available balance of $90,000. Since there has now been invoice (voucher) activity against the purchase order, the system will not select it for PO Rollover.

- This scenario assumes a beginning budget of $120,000 in Fiscal Year 2018

- When another invoice (voucher) is processed for $5,000, expenses will increase by $5,000 and the encumbrance reduce by $5,000, resulting in no change to the available balance of $120,000. However, when looking at annual budget reports, you will now see a negative encumbrance.

- When Purchasing or Accounts Payable closes out this purchase order, the remaining $1,000 in encumbrance will increase the negative encumbrance and the available balance by $1,000

- To clear up any confusion caused by negative encumbrances, the Controller's Office will remove the negative encumbrance and the Budget Office will increase the FY18 budget by the amount of the paid invoices resulting in a zero budget impact for this PO in FY18. (NOTE: the FY18 budget will only be increased if the department had sufficient budget funds in FY17 to cover the amount of the paid invoices.)