1099 Processing

1099 Processing

-

Reporting Tools>Query>Query Manager

- Run CU_1099_Key_Word_Search query

- This query will pull up a list of Vouchers with Keywords in the description that do not have a withholding on them

-

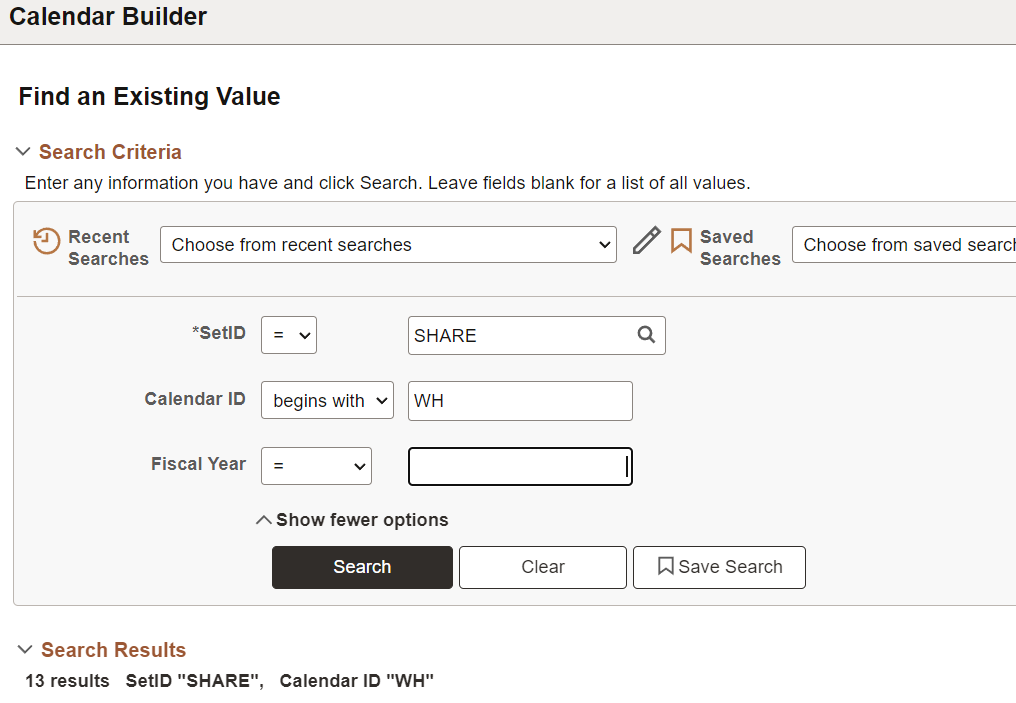

Set Up Financials / Supply Chain > Common Definitions > Calendars/Schedules>Calendar Builder

-

Review PS_PYMNT_VCHR_WTHD data

- Before running the Post Withholding process, query any Withholdings in the PS_PYMNT_VCHR_WTHD table that do not match the voucher amounts, and send the results to AP to review (update the account date criteria)

-

select P.WTHD_TYPE, P.WTHD_BASIS_AMT_ENT, V.GROSS_AMT, V.VENDOR_ID, E.NAME1, V.VOUCHER_ID, V.INVOICE_ID, V.INVOICE_DT from PS_PYMNT_VCHR_WTHD P join PS_VOUCHER V on P.VOUCHER_ID=V.VOUCHER_ID join PS_VENDOR E on V.VENDOR_ID=E.VENDOR_ID where V.ACCOUNTING_DT>='2024-01-01' and V.GROSS_AMT=P.ORG_WTHD_BASIS_ENT and P.WTHD_BASIS_AMT_ENT<>P.ORG_WTHD_BASIS_ENT order by V.VENDOR_ID - If they determine the amounts in the previous query should be fixed run a sql update statement

-

update P set P.WTHD_BASIS_AMT_ENT=P.ORG_WTHD_BASIS_ENT from PS_PYMNT_VCHR_WTHD P join PS_VOUCHER V on P.VOUCHER_ID=V.VOUCHER_ID join PS_VENDOR E on V.VENDOR_ID=E.VENDOR_ID where V.ACCOUNTING_DT>='2024-01-01' and V.GROSS_AMT=P.ORG_WTHD_BASIS_ENT and P.WTHD_BASIS_AMT_ENT<>P.ORG_WTHD_BASIS_ENT

-

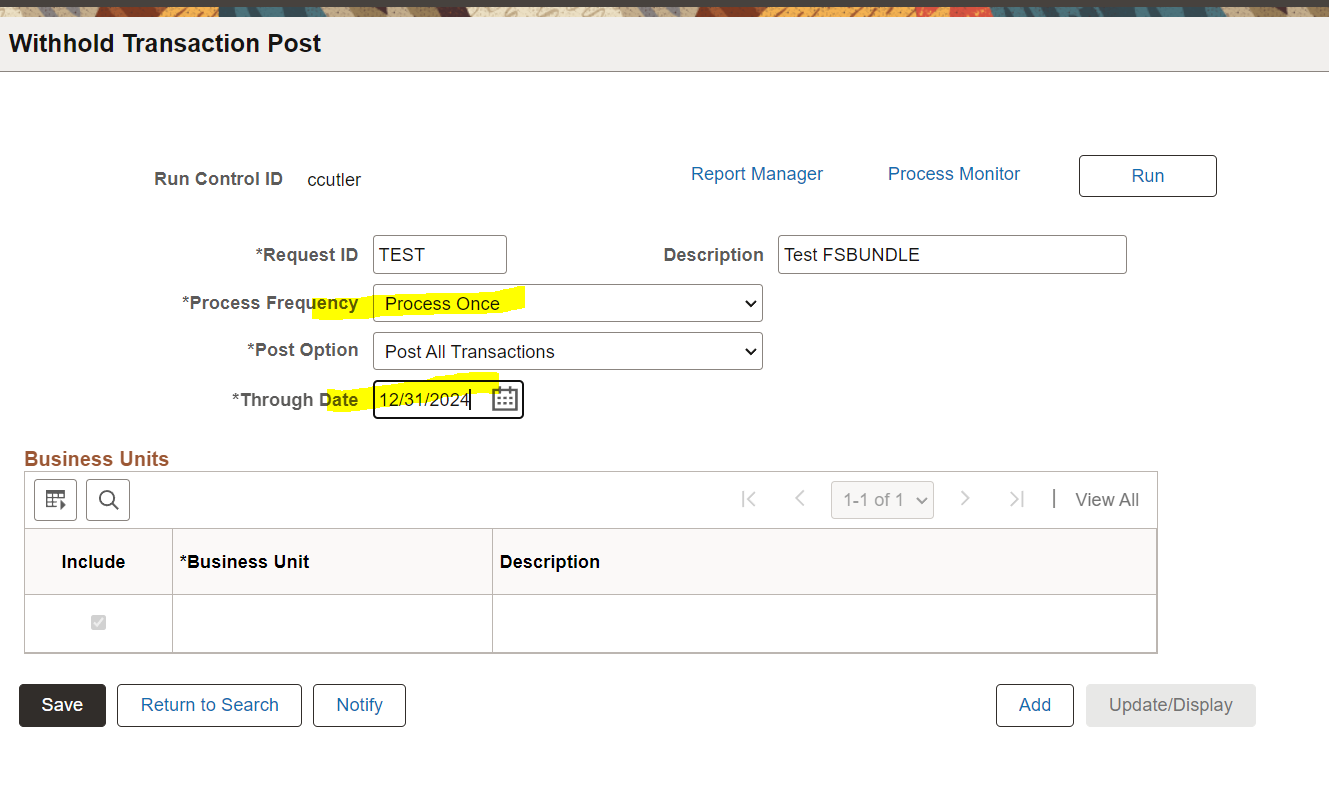

Suppliers>1099/Global Withholding>Maintain>Post Withholdings

-

Review PS_WTHD_TRXN_TBL data

- Once the WTHD_BASIS_AMT_ENT amounts are corrected and the AP_WTHD process has been ran, check for any amounts in PS_WTHD_TRXN_TBL that do not match up with the payment table.

- Using the process instance from the AO)WTHD process ran in step 4 query for any payments that do not match up to the withholding amount

-

select W.WTHD_TYPE, WTHD_BASIS_AMT, P.PYMNT_AMT, W.VENDOR_ID, E.NAME1, P.PYMNT_ID_REF from PS_WTHD_TRXN_TBL W join PS_PAYMENT_TBL P on W.PYMNT_ID=P.PYMNT_ID join PS_VENDOR E on W.VENDOR_ID=E.VENDOR_ID where W.PROCESS_INSTANCE = 1532837 --process instance from AP_WTHD and W.WTHD_BASIS_AMT<>P.PYMNT_AMT order by W.VENDOR_ID - send the list to AP for review

- Suppliers>1099/Global Withholding>General Reports>Wthd Voucher/Supplier Mismatch

- Run the PS job withholding mismatch report

- Reporting Tools>Query>Query Manager

- Run query to add vendor_Loc to the missmatch report ran above

- Suppliers>1099 Global Withholding>Maintain>Update VoucherLine Withholding

- Find a vendor and select invoices to include or exclude withholding-21 Lincoln's Pest Control (chose exclude withholding)

- Suppliers>1099/Global Withholding>Maintain>Adjust Withholding

- Adjust withholdings by dollar amount rather than by invoices like last step-56 Great Northern 99 Amount adjusted 175 and 190

- Vendors>1099/Global Withholding>Maintain>Update Supplier Withholdings

- Run vendor update

- Suppliers>1099/Global Withholding>Maintain>Update Withholdings

- Run Withholding Update

- Suppliers>1099/Global Withholding>1099 Reports>Withhold 1099 Report Job

- Run job to generate 1099s

- Run job to generate 1099s